Dan Ferris’ Extreme Value Research is a monthly investment advisory focused on the lowest-risk, best value stocks in the market. Read our Dan Ferris Extreme Value Review to find out latest Extreme Value Portfolio Picks.

Table of Contents

- 1 Dan Ferris Extreme Value Review – What Is It?

- 2 How Does Dan Ferris Extreme Value Work?

- 3 Who Is Dan Ferris?

- 4 The Next Great Crash Has Likely Already Begun – Inflation Bubble !!!

- 5 The World’s Two Most Valuable Assets in a Time of Crisis

- 6 The Hands-Down, No. 1 Pick of My Career – The Best Gold Business on Earth

- 7 Dan Ferris Extreme Value: The 10-Stock Inflation Protection Portfolio

- 8 Dan Ferris Extreme Value Review – What Do You Get for Your Money?

- 9 Dan Ferris Extreme Value Pricing

- 10 Dan Ferris Extreme Value Refund Policy

- 11 Bottom Line: Should You Join Dan Ferris Extreme Value?

Dan Ferris Extreme Value Review – What Is It?

Extreme Value Research is an email newsletter focused on investment ideas, market analysis and stock picks.

Subscribers can follow analyst’s Dan Ferris’s strategy of buying low-risk, under valued stocks.

More than 20 major financial firms and well-known money managers already follow their recommendations.

As a result of his work in Extreme Value, Dan has been featured several times in Barron’s.

He has appeared on Money with Melissa Francis and The Willis Report on Fox Business News as well as numerous financial radio programs around the country.

Many people feel comfortable investing in Extreme Value stocks not only because they are low risk, but they are also considered one of the most profitable ways to invest.

Here is snapshot of their portfolio:

Source: stansberryresearch.com

Subscribers do not receive multiple recommendations every month.

Dan and his team spend endless hours of research, comparing the intrinsic value of different businesses with their market value.

When they find a company that is trading substantially lower than their intrinsic value, they let the subscribers know.

Dan doesn’t recommend stocks that don’t have clear margin.

Here are answers of some of the most common questions about this service.

Source: stansberryresearch.com

How Does Dan Ferris Extreme Value Work?

Generally Extreme Value is much more than just an investment letter.

Members receive monthly analysis of current market including details of investment recommendations.

Each recommended investment will have the potential to double or even triple your money.

You will have access to Dan’s library of educational resources and dozens of special reports and recommended reading lists.

Dan and his team believe that with all this additional information they could transform the way their subscribers think about investing.

This could be first step of improving your financial position despite the resent market crash.

Who Is Dan Ferris?

Dan Ferris is one of the first analysts that joined Stansberry Research in 2000, shortly after the launch of the company in 1999.

He is the editor and top researcher of Extreme Value Research Service.

If you do not know him already, you will be impressed how deep he goes in his research.

He is a brilliant thinker and hard worker with great track record.

He spends many hours each month analyzing financial reports and SEC fillings to find the right stocks.

Stocks currently trading at huge discounts to their true value.

This is how he gives his subscribers large margin of safety.

Dan Ferris uses a classic value-investing philosophy to make some of the biggest and safest returns.

He is the master of patiently waiting for the perfect opportunity.

Over the past 20 years, he was not only consistently predicting and avoiding the biggest risks in the market.

He was also able to find many triple-digit opportunities, including 198% in Alexander & Baldwin, 117% on Encana, 248% on International Royalty…

Another source to learn more about Dan Ferris and his investing philosophy is to listen to Stansberry Investor Hour podcast where he is a host.

It is 100% Free.

Just use your email and you will get access to the latest episodes on the confirmation page.

The Next Great Crash Has Likely Already Begun – Inflation Bubble !!!

According to Dan Ferris, the market could fall very soon as much as 20% for a single day.

He says this collapse is not just likely to happen.

It may well have already begun.

In the next few years, a lot of people are going to lose nearly everything they’ve saved during good market times.

No worries– this is completely avoidable with Extreme Value and its team. Dan has spent an entire lifetime learning how to avoid it. He knows what to do to be protected against what’s coming.

In this rare on-camera interview with Daniela Cambone, he is showing us the proof of his prediction.

If you are worried about what will happen next in the markets, this interview is for you.

We’ll go over some of the major points Dan and Dani are discussing in this interview.

There is no mystery of what is happening right now.

Take a look at the big picture….it is definitely a BUBBLE.

Dan compares this moment to 2008…2000, and even 1929.

A lot of other smart people are thinking the same way.

Robert Shiller (The Noble laureate economist) warned that stocks and bonds have never been so overpriced in modern history.

For example, let’s compare the total market cap of the S&P 500 to our entire country’s GDP (the value of all goods and services we produce).

The historical average is around 80%.

Back in 2000 bubble that number was 121% right before the crash.

Today it is at 211%. It is all-time record. This means that the stocks are grossly overvalued. This could be the beginning of the next bear market.

We’ve just experiences more than a decade of the best market conditions.

People don’t get a lot of opportunities in life to experience this. Most of us probably will never witness this again.

Make sure you do what is necessary to keep this money! Dan is not recommending selling everything and get out of the market.

Ferris is talking about critical mistakes that people do, and he shares the best defensive recommendations for FREE.

The World’s Two Most Valuable Assets in a Time of Crisis

You know that the gold has been a store of value since at least the ancient Egyptians, 5,000 years ago. It offers protection you can’t find in any asset that can be manipulated, like most stocks or like Bitcoins.

Dan thinks that people should hold some gold bullion or gold through an ETF that’s backed by physical metal, rather than real, physical gold.

You should do some research on your own because there are some good ones (not G-L-D, which is the largest gold ETF) that are based on complex engineering with futures contracts.

If you decide to skip Dan’s research and spend your money somewhere else, take advantage of his recommendations.

This could be your approach for the next five years.

It will put you in a better place than most of the people:

- Buy some gold. Dan recommends ticker symbol P-H-Y-S. Based on his opinion it is much higher quality way to own gold.

- Consider a commodities ETF

- Buy some land

- Own some hard assets like food supply, mines, things that keep our world running.

Owning essentials is a good strategy, especially in an economic crisis. Their prices skyrocket during times of inflation.

If a movie ticket costs five times more, you just don’t go. But if a barrel of oil is five times more, the world still needs it. In this situation, better own the oil company, not the movie theater.

The Hands-Down, No. 1 Pick of My Career – The Best Gold Business on Earth

Let’s zoom out and look at the big picture again.

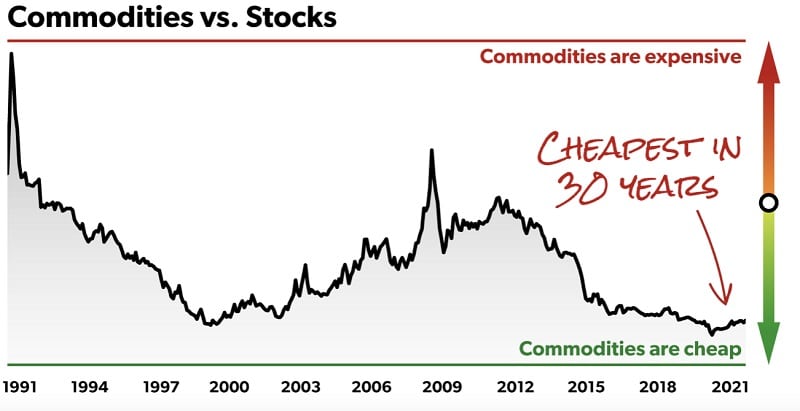

Commodities are ridiculously cheap right now.

This chart shows you the ratio between the S&P GSCI Commodity Index and the Dow.

Commodities vs. Stocks since 1991:

Source: stansberryresearch.com

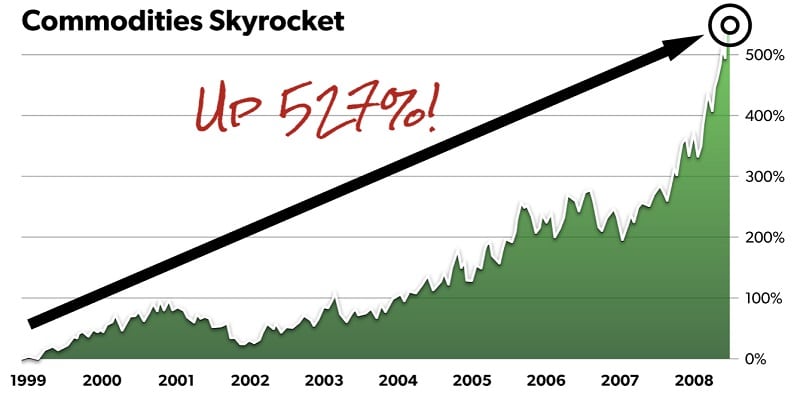

Commodities are the cheapest relative to stocks since the lows of the dot-com bubble 20 years ago.

The last time we had this setup they went up 500%.

Source: stansberryresearch.com

Dan is expecting same thing to happen again.

Even if the market does not crash in the next 5 years, even if somehow inflation stays reasonable, Ferris would still recommend investing in commodities today.

But let’s get back to the main point – Dan Ferris’ #1 stock pick “The Best Gold Business on Earth”:

He is talking about a royalty-like business.

A royalty on a huge portion of the gold market itself.

As long as people want to own gold, the business makes money.

In this environment the demand for gold will skyrocket together with the potential of this company.

No investment is risk-free, but Ferris believes that this stock represents the biggest margin of safety you will find in the market.

Dan is very protective of his ideas and the rights of Extreme Value readers.

Stansberry readers have had the chance to make some large gains on royalty stocks over the years. They are talking about 200% or 300% gains.

This business is barely covered by analyst. But Ferris consider it the single best stock he has ever uncovered in his life.

It is 10 times better than investing in gold or any company mentioned above. It has an incredible margin of safety.

Dan has put together an entire model portfolio called:

Dan Ferris Extreme Value: The 10-Stock Inflation Protection Portfolio

Inflation in December hit the highest rate in 40 years.

This problem is not only in United States.

There is natural gas problem in Europe and prices are up about 500%.

Coal prices in India are up 700%

Inflation at this rate is a financial disaster even if we somehow miraculously avoid a crash anytime soon.

It is going to eat the value of your cash and the value of every business around the world.

Dan Ferris has a simple plan for what to do to protect your savings and prosper in the coming years without selling everything or using risky short selling or put options.

It is crash protection, it is inflation protection, and it is set up to soar over the next decade.

Allocating just 10-20% of your investing dollars into his approach could secure your financial future over the next few years.

Then if you want to keep some money in speculations, go for it. Dan Ferris recommendation is to keep your speculation bucket relatively small these days.

But he highly recommends you set aside at least 10%, even better 20% of your investing money to buy this entire portfolio today. All 10 stocks.

Besides “the Best Gold Business on Earth”, he reveals information about two more royalty plays.

Second one is I LOVE. It was one of his favorite stocks for years, until he found “the Best Gold Business on Earth”.

It is not a gold play. It is something way bigger than any precious metal. It’s a royalty on a metals market. A royalty on potash fertilizer. A royalty on energy production. All in one company, run by the best capital allocators.

Don’t forget, royalty companies don’t do the hart work of producing or extracting. They buy assets at the bottom. Then they sit back and collect a percentage of everything that is produced. And then, they sell at the top.

It is a stock that you could liquidate. Sell off every asset of the company, and you end up with about 40% more than its trading price. This gives you an incredible margin of safety.

Third company plays on renewables with the same world class management.

Not sure what you personally think about climate change or green energy.

Many smart people believe that the transition to renewables is going to be the most important factor driving the next commodity super cycle.

Especially with the energy crisis that is going on right now.

Governments all over the world will pour trillions into it.

Four stocks in this portfolio are plays on infrastructure.

They are essential to housing, road construction, waterworks, internet buildout.

They own valuable equipment and facilities, as well as significant real estate portfolios.

Dan calls one of these four stocks “a World Dominator”. It’s raised its dividend in 31 of the last 33 years.

The names of other three stocks are also from wildly mispriced companies. This is a typical example what are Extreme Value recommendations. The goal of their team is to find the stocks that are off the radar of most investors and analysts.

These companies own a lot of valuable assets – factories, real estate, construction equipment.

They are the main builders of our infrastructure – roads, power sources, water, and sewer.

The government is spending trillions to prop up the economy. These expenses are likely to increase in the coming years.

The Fifth company from this portfolio is a business involved in insurance. They insure real physical assets.

When the value of these assets goes up, the premiums also increase.

This 10-stock plan is built to protect your portfolio.

Just make a plan that includes these 10 stocks.

Buy them and stop worrying about the bubble and the inflation.

You can watch them grow for the next five years.

Below you can find the details how you can gain access to 10-stock Inflation Protection Portfolio, along with access to Dan Ferris’ Extreme Value Research.

Dan Ferris Extreme Value Review – What Do You Get for Your Money?

Here is a complete list of everything included in this subscription.

Keep in mind that you will receive not only reports, newsletters, and updates. In fact, you will have Stansberry’s longest-serving analyst and #1 value expert on your team through the expected market collapse, high inflation, and shortage of resources.

Limited-time discount: Two years of Extreme Value including special updates.

Get 2 years of Extreme Value including special updates here. Each month you will receive Dan Ferris’ latest ideas, investing insides and big picture analysis. If necessary, you will get updates with information when to lock-in gains, add or sell positions.

10-stock Inflation Protection Portfolio

Their brand new 10-stock Inflation Protection Portfolio with details about each recommendation.

Bonus 1: The Hands-Down #1 Pick of My Career

This subscriber only report is considered the crown jewel of this portfolio.

Bonus 2: The World’s Two Most Valuable Assets in a Time of Crisis.

This report is shared with special permission from Dr. David Eifrig. In this bonus report you will find details of two hard asset investments that shined during the last two financial crises.

Bonus 3: One Free Year of Commodity Supercycles

This is Stansberry’s premiere commodity investing research service. It could be helpful to select some of the biggest winners in the markets in the coming years. It is FREE for one year. No commitment. Automatic renewal is NOT included.

Dan Ferris Extreme Value Pricing

The usual price for Extreme Value is $2,000 per year. This is advanced level research service. Its regular price is about half what almost any comparable research service costs.

For a short time and only on this special offer page you will be able to get TWO full years of Extreme Value for only $1,495 plus applicable taxes.

This price is 65% OFF the normal 2-year subscription.

Dan Ferris Extreme Value Refund Policy

This offer does not allow cash refunds. They cannot allow you to join, receive the complete model portfolio, and then refund right away.

If you try Extreme Value for 30-days, and you are not satisfied with your membership, you can receive your money back in the form of Stansberry Credit. This credit can be applied to any of their other products in the next one year.

Bottom Line: Should You Join Dan Ferris Extreme Value?

Extreme Value is the real deal because it offers high quality, best value stocks with the biggest, safest returns on the market. You will get significantly more dollar-for-dollar value from your subscription, comparing to cheaper entry-level research services.

No wonder why Stansberry Research founder, Porter Stansberry called this research “The best newsletter in America at any price.”

Here is some more information that we did not mention in our review so far:

The average annualized return from Extreme Value in 2020 was 78%. This return measures the results achieved by all their recommendations in 2020, scaled to a one-year period.

If you decide to continue receiving Extreme Value in the future, you can keep the 65% discount as long as you stay on.

The most important is that with this subscription you have one of the most passionate and persuasive financial analysts on your side. His mantra is: “Prepare, don’t predict”.

Do you feel prepared for the coming years…no matter what happens in the markets?

Ready To Try Dan Ferris Extreme Value – Click Here – Best Offer + Bonuses