Joel Litman and Rob Spivey just launched their first research together – Credit Cashflow Investor. Its whole focus is the No. 1 strategy for crises like the one we see coming.

Table of Contents

- 1 Credit Cashflow Investor Review and Joel Litman’s Big Warning

- 2 Question #1: What’s your big crisis warning?

- 3 Question #2: How are you so sure a crash is coming?

- 4 Question #3: How is your new Credit Analyzer different from your Altimeter system?

- 5 Question #4: Why bonds?

- 6 Question #5: Do I need to open a new account? How much money do I need to get started?

- 7 Question #6: Should I be selling my stocks?

- 8 Question #7: I already have a bond letter. Why do I need a different one?

- 9 Question #8: What are these Credit Cashflow Investor seven special bonuses I keep hearing about?

- 10 Question #9: What exactly are you looking at when you’re analyzing these bond opportunities?

- 11 Question #10: Is there a replay of the Joel Litman’s Big Warning presentation available anywhere?

- 12 Question #11: If Credit Cashflow Investor new tools are so critical, why haven’t you shared them with the public until now?

Credit Cashflow Investor Review and Joel Litman’s Big Warning

A few days ago, Joel Litman went on record with his biggest warning since 2007:

Every dollar in the stock market is in serious peril today – and the delusional bulls who keep pumping up this bubble are putting people in danger.

This is why Rob Spivey and Joel Litman just launched their first research service in years – Credit Cashflow Investor. Its whole focus is the No. 1 strategy for crises like the one we see coming. (You can still join here for 50% OFF the normal price.)

And they’re hardly the only ones sounding the alarm.

Billionaire Jeffrey Gundlach – CEO of DoubleLine Capital – just warned about a wave of financial carnage and said anyone who doesn’t see what’s coming is “an ostrich with your head in the sand.”

What’s causing this danger?

Gundlach sees it exactly the way Joel does. As he put it:

“This debt coming due would be just devastating. The Fed can’t have interest rates at 5%, 6% and hold them there for the next few years without bankrupting everything about this country.”

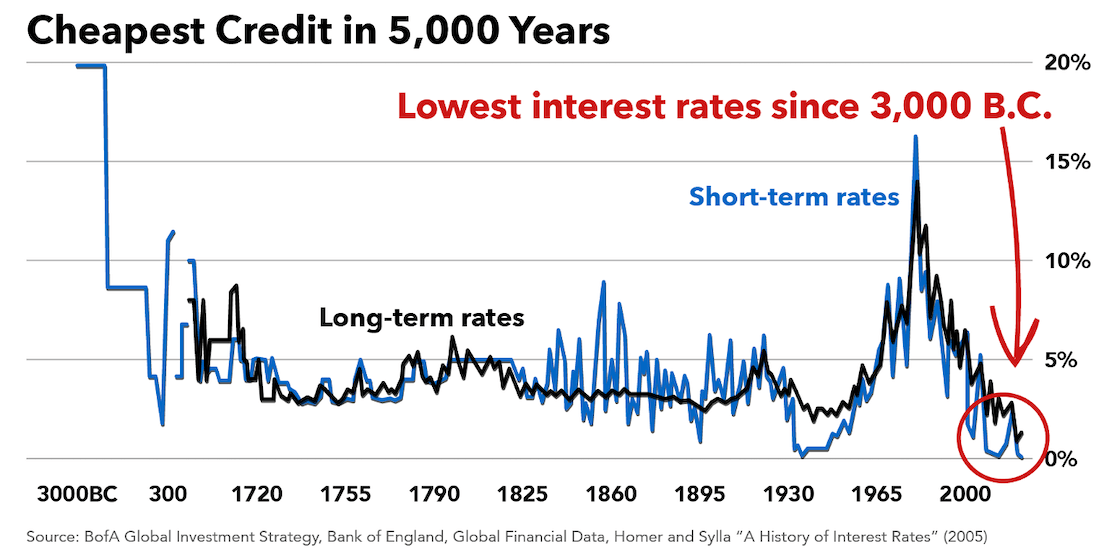

Keep in mind: We just had the lowest interest rates in 5,000 years, two years ago. Everyone assumed they’d stay that way forever – and acted like it.

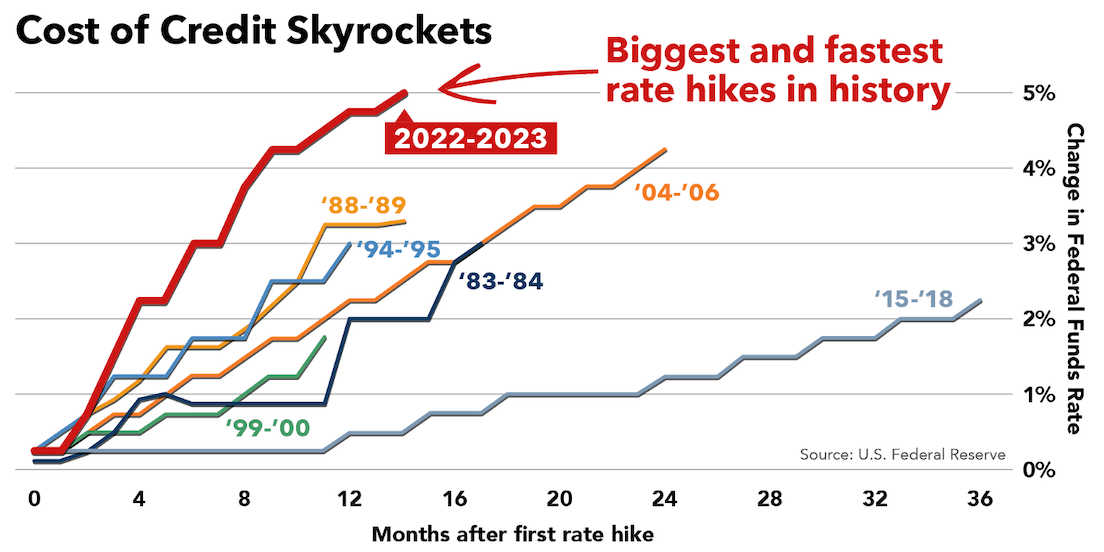

Then the Fed gave us the largest and fastest increase in interest rates on record…

And the bulls are pretending this can all be just fine – no costs for businesses… debtors… or the economy. No consequences.

Sorry, it doesn’t work that way. It never has and it never will.

Please, don’t be a victim yourself.

Joel Litman is predicting a wave of corporate bankruptcies that will spark a 2008-like panic. It could make the bankruptcies we’ve already seen this year look like the opening act.

And it’s why Joel and Rob Spivey have just issued an urgent blacklist of the WORST possible stocks to own right now.

It’s in their newest special report: Avoid the Carnage: 10 Stocks to Make SURE You Don’t Own.

You’ll receive this report, absolutely free, when you join Credit Cashflow Investor as a Charter Member today.

Please read it right away. The credit picture for these 10 stocks is worse than terrible. They’re flat-out toxic.

Many of these companies are household names you’ve definitely heard of. I wouldn’t be surprised if you own at least one of them outright or in an ETF.

As debt comes due, Joel Litman expects these companies will join the growing wave of bankruptcies. And just like in 2008, the first handful could trigger a chain reaction:

Big institutions may sell off their holdings indiscriminately. They often have to sell because of automatic triggers… or to meet a sudden flood of redemption demand from panicked investors pulling their money out.

Leading to even more selling… and a market collapse.

For the public, it will seem to happen all at once – like a dam bursting.

Rob, Joel, and this CEO Jeffrey Gundlach are only saying out loud what many billionaires and hedge funds already know – but won’t tell you for a lot of self-serving reasons.

Even Warren Buffett is pulling billions out of the market.

Virtually all of them are preparing to use ONE strategy to survive what’s coming, and it’s the one Joel and Rob cover in depth in Credit Cashflow Investor.

More than $50 trillion of stocks and bonds will be affected by this crisis. Fortunes could be lost in a matter of weeks or months, like in 2008.

And mark Joel’s words: Folks in the media will say that “nobody saw it coming.”

But that’s not true. Folks like Gundlach… Buffett… they all KNOW this disaster is coming.

Of course, in addition to Avoid the Carnage: 10 Stocks to Make SURE You Don’t Own…

You can also instantly claim access to The Secrets of Credit – And our Credit Cashflow Investor Strategy – which is likely the single most important report Altimetry Research have ever published, period. (Far more than any individual investing idea or list of ideas.)

And you’ll get instant access to Cashflow Now: 10%-Plus Bonds to Start Your Credit Cashflow Investor Portfolio – so you can get started on this strategy right away. (And I recommend you do, before hundreds more newcomers potentially flood in.)

You can claim all three FREE bonuses right now when you join Credit Cashflow Investor today (at the lowest price they’ll ever offer).

Click here to review the full Charter offer, before it expires.

Below, we will post an extended Q&A where Joel’s answering the top questions he received during Wednesday’s event – you can find Joel Litman’s responses below…

Question #1: What’s your big crisis warning?

In plain English, I see a stock market that’s totally out of whack – much like it was in late 2007.

I know the market bulls have been trumpeting that we dodged a bullet. They’re saying spending’s up, and inflation’s coming down, so we’re “in the clear.”

It’s ludicrous. It’s a giant delusion… and it’s going to cause real people to get hurt, if they don’t pay attention.

Every indicator I’m looking at shows this is the most dangerous environment for stocks that I’ve seen since 2007.

I’m not saying what happens next will be quite as severe.

(Though it could be.)

However, it’s going to get ugly over the next 24 to 36 months.

And this is definitely not a time to have your money in stocks.

(There will be exceptions, of course, which is why today’s offer includes full access to my stock-picking system, the Altimeter Pro. I want you to be able to run EVERY stock you own or are even thinking about owning through it so you don’t get blindsided like I expect everyone else in the market will be.)

To be clear, this dangerous window for stocks isn’t some future catastrophe…

It’s right now. It’s already begun.

You’re likely already feeling the effects , along with many other investors right now. It’s why you might be feeling nervous… uncertain… or confused by this stock market.

And you’re smart to feel that way…

Something doesn’t feel right because it’s not.

What the bulls are failing to tell you, and what the media doesn’t understand, is the single most reliable signal in the world when it comes to predicting a recession and a crash…

And right now, it’s flashing bright RED.

Click here to review the full Charter offer, before it expires.

Question #2: How are you so sure a crash is coming?

Because the credit market forecasts pain for the stock market.

It has correctly predicted the crashes of 2020… 2008… 2001… even 1929.

It’s THE most important vital sign for the economy.

And right now, it’s telling us the economy is about to have a heart attack.

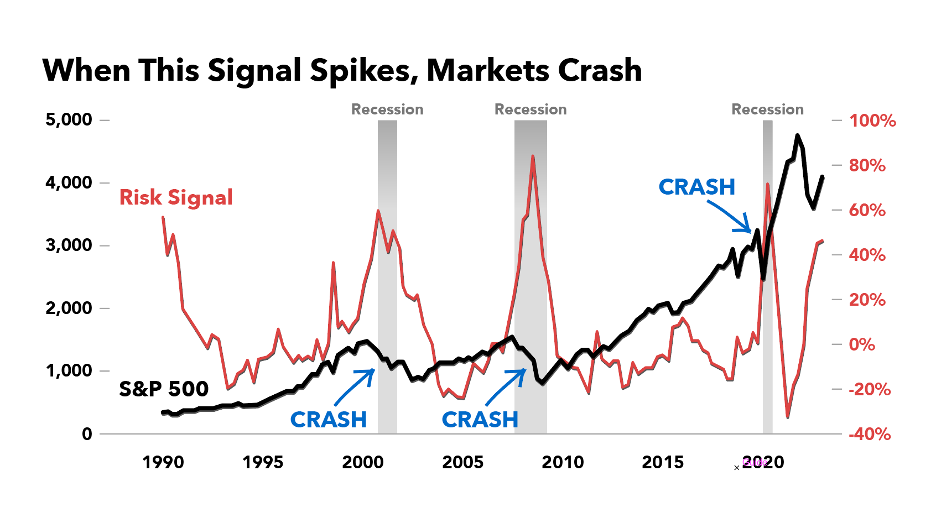

Take a look:

Every time the red line spikes, markets crash. Every time.

It couldn’t be clearer. It’s doing the exact same thing it did in 2001… 2008… and 2020… the last three big crashes.

Not to mention, my team tracks over a dozen metrics of credit market health. And over the last year or so, every single one has gone from green… to yellow… to red.

There’s NO green anywhere today. One or two might be yellow, but most of them are reds.

For example…

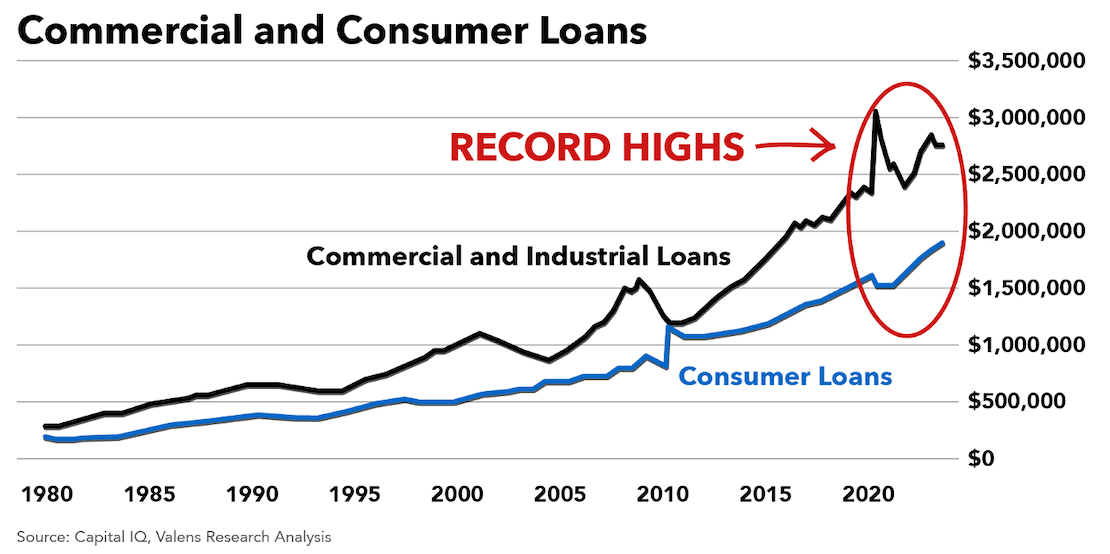

Right now, both companies and individuals are sitting on more borrowed money than pretty much any time in history…

Why? We literally just had the lowest interest rates in 5,000 years. Credit’s been plentiful and dirt cheap…

Now, we’ve just been hit with the biggest, fastest increase in rates on record…

In other words, we got addicted to easy credit and buried ourselves in debt, assuming the easy money would last forever.

Now, the bill’s coming due.

And we’re about to get a rude awakening.

Credit just got A LOT more expensive… banks aren’t lending money as easily as they used to… everybody has bills coming due and no way to pay them…

Why does that sound so familiar?

Because it’s what happened in 2008 – which is how I knew to sound the alarm back then, too, just before stocks crashed 50%.

So please, take this warning seriously…

It might be the only one you get.

Rob and I created Credit Cashflow Investor for this exact reason – because stocks are not the place to have most of your money over the next few years.

That’s actually pretty rarely the case for most people – but it is right now.

We’re extremely worried about the state of the market and what we see coming.

Yet when this crisis happens in stocks – it creates a massive opportunity in mispriced credit.

Not by some weird coincidence – but for the exact same reasons

So instead of being a financial disaster for you, these next few years could be the opportunity of a lifetime.

We’ll walk you through our No. 1 favorite strategy for periods like this. One we know, from years of experience using it with clients, is the best way to avoid big losses in a crisis.

For many of the world’s greatest investors, it’s their No. 1 favorite strategy ever – and they wait patiently for years for periods exactly like this.

I assure you: If you know what you’re doing, it can be the best few years of your financial life.

Click here to review the full Charter offer, before it expires.

Question #3: How is your new Credit Analyzer different from your Altimeter system?

Great question…

We designed the Altimeter to detect unknown hidden buying opportunities in the stock market.

It scans the balance sheets, income statements, and cash flows of 32,000 public companies… flags more than 130 common accounting problems that impact a company’s reported earning power… and then corrects them.

In other words, you’re getting a company’s TRUE earning power.

Which is often dramatically different than the number posted on Yahoo Finance.

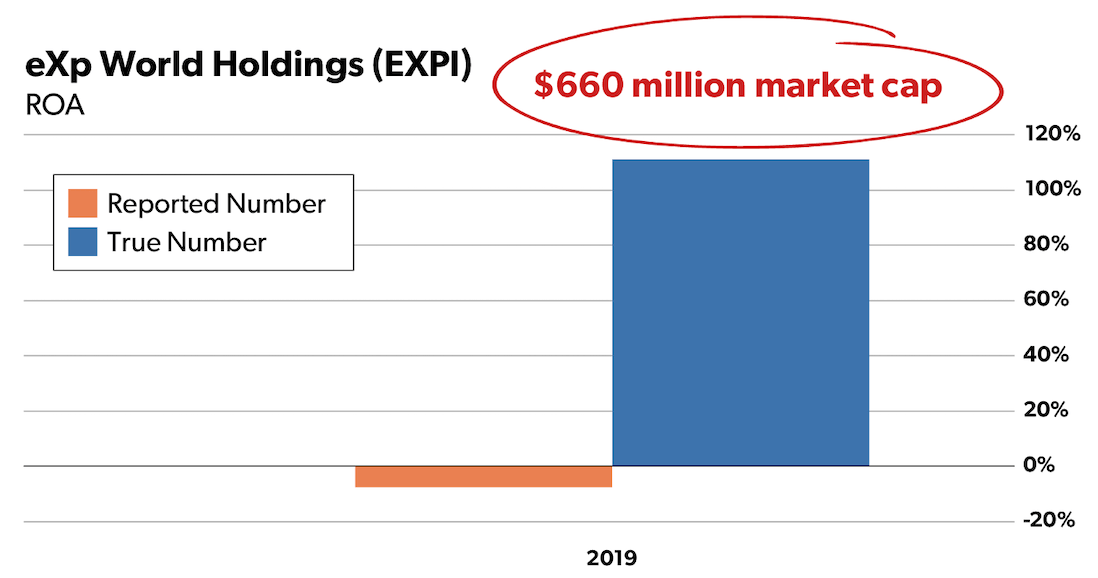

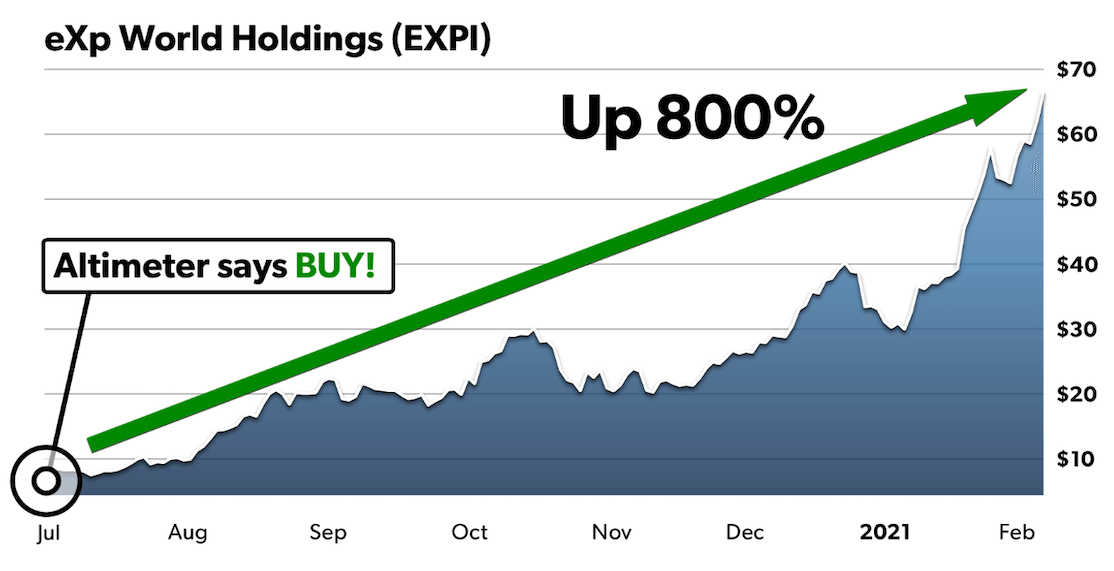

It’s how the Altimeter detected a massive earnings distortion in software company eXp World Holdings…

Right before it soared nearly 800% in less than a year…

And we’ve used the Altimeter to pinpoint the dozens of triple and quadruple-digit winners we’ve had over the years for clients and readers:

- 4,200% gain on AMD

- 1,364% gain on MIDD

- 212% gain on PLNT

- 159% gain on GMCR

- 144% gain on OPEN

- 111% gain on RICK

- 116% gain on BLFS

- 106% gain on MOV

- 125% gain on ADT

- 148% gain on UNFI

- 107% gain on LIVN

- 110% gain on KFY

- 106% gain on EXLS

- 128% gain on LPLA

- 118% gain on GNRC

- 110% gain on COF

- 130% gain on F

- 168% gain on FRX

That said, the Credit Analyzer is our NEWEST system, never before shown to or shared with the public until this week.

It gives you a quick snapshot of the credit health of any U.S. company you own or care about.

Simply enter the name or ticker symbol of any publicly listed, nonfinancial U.S. company with debt outstanding to see the truth about their creditworthiness… and not the bogus, backward-looking rating of the big agencies.

You’ll see a visual guide to each of the powerful credit metrics they follow… and one easy-to-understand overall, invaluable credit grade.

This is the tool that can instantly make you better and more successful in every type of investing you may do – and give you the critical half of the picture you’ve been missing all your life.

Now before you ask me, “Joel, which tool should I prioritize for this crisis you’re talking about – the Altimeter or the Credit Analyzer…?”

My answer is: YOU NEED BOTH!

But the Credit Analyzer is unlike any other tool that exists in the world today, anywhere, as far as I know.

And because credit is at the epicenter of the crisis unfolding today, this tool is going to be incredibly important over the next few years – no matter what kind of investments you might own.

Like I said, we’re heading into the most dangerous environment for stocks since 2007.

You need to understand the risk profile of EVERY company you invest in… which stocks are heading for brutal losses… and which stocks could make you money despite the carnage (there will always be a few).

So, the Altimeter and the Credit Analyzer are a perfect match for each other.

And as a “thank you” for joining me today – I’m giving you a year of access to BOTH systems, 100% free.

Click here to review the full Charter offer, before it expires.

Question #4: Why bonds?

Bonds can routinely pay you a double-digit yield… and sometimes double your upfront investment, or more, on top of that, under the conditions we’re about to see.

In fact, I’ve seen these kinds of bonds return 500%… 600%…. 700% in total in some cases.

Best of all, bonds are an enforceable debt. The issuing company legally owes you that money – plus interest payments.

It’s like a stock whose future price you know for certain.

(Stockholders can’t say the same. If a stock crashes, those folks are out of luck.)

Mark my words: Bonds will be the No. 1 strategy in the world over the next few years. And when the crisis hits in full force, the opportunities will get extraordinarily good.

You’ll have the chance to double or triple your money (or more) while everyone else is panicking and running for the exits.

And you’ll collect a (legally owed) interest yield of 10%… 15%… even 20% or more while you wait for your payoff.

You want to be heavily in bonds today, more than any other time.

That’s the advice I’d give to my mom… to my friends and relatives… and it’s the advice I’m giving you today.

Remember, I’m not talking about Treasury bonds… or the boring bond funds that pay near-zero returns in folks’ retirement accounts.

These are individual, corporate bonds issued by just about every company in America. You can buy and sell them just as easily as a stock, in any standard brokerage account.

We’ll show you exactly how.

And remember, we haven’t launched any new research in more than three years. That’s by design. We DON’T bandwagon on trends. And we take our responsibility to you, our readers, very seriously.

We only introduce new research when we’re sure it’s the best and most important thing we could possibly bring to you as a reader… and we’re sure now is the time to launch Credit Cashflow Investor.

It’s going to be desperately needed, with what we see coming.

And don’t worry…

Rob and I will lay out in clear, plain English and detail everything you need to know about our bond strategy.

How to buy a bond. How much and how often it pays you. How to understand terms like “coupon” and “maturity”. How to build a balanced portfolio. How we’ll use our extraordinary tools to minimize risk on every recommended play.

We’ll answer everything – and teach you a strategy you’ll likely want to continue using for the rest of your life.

It’s likely the most important research we’ve ever produced, or ever will.

Rob and I have poured our hearts into this new service, and I think you’re going to love it.

Click here to review the full Charter offer, before it expires.

Question #5: Do I need to open a new account? How much money do I need to get started?

No, you don’t need a new account if you don’t want one. You can buy and sell these bonds in any brokerage account – Fidelity… Schwab… Vanguard.

As far as money to invest, it’s up to you – but if you don’t have at least $10,000 or ideally $20,000 to deploy, you might be wasting your time.

Just like with stocks, you need to diversify for the best results. And most bonds have a contractual value of $1,000, even though they can trade above or below that number. So, for real diversification, you’re looking at $10,000 or $20,000.

But keep in mind, this is a really good time to be trimming and even closing out your more risky stock positions.

So for a lot of people, it’s only a matter of shifting money over to this strategy.

And you can definitely do that a little bit at a time.

Click here to review the full Charter offer, before it expires.

Question #6: Should I be selling my stocks?

We’re NOT saying, “Sell everything.”

But we ARE saying this is going to be a very difficult environment for stocks…

Most will go down when the crisis hits, for sure.

That’s a big reason why we’re giving the full version of the Altimeter Pro, which normally costs $1,200 per year for FREE to anyone who accepts today’s Charter offer. Because I want you to go check on the health of every single stock you may own.

I absolutely think you should be freeing up some money for our Credit Cashflow Investor strategy.

And, again, I think it’s wise to do that by exiting or trimming your riskier stock positions, especially if you’ve been more invested in stocks than you should be… chasing the hopes of a bull market that has to end.

Oh, and one more thing…

In a few years, when the credit crisis has really taken its toll… there’s going to be a generational buying opportunity in stocks. A 2009-like moment.

I want you to be ready for that.

Along with the Altimeter, you also get Timetable Investor, which is the easiest, most straightforward way to get our macro view at any time every single month. Read it. Because we will definitely let you know when that big buying opportunity comes.

In the meantime, please – use the strategy we’ve shown you today. You’re going to be so happy you did.

Click here to review the full Charter offer, before it expires.

Question #7: I already have a bond letter. Why do I need a different one?

If you’re reading this, you may be familiar with our friends and corporate affiliate Stansberry Research.

Since 2015, they’ve been publishing a research letter called Stansberry’s Credit Opportunities – that follows a similar strategy.

I can’t say enough about this work. It’s completely pioneering. The editor that writes it, Mike DiBiase, is a wizard at finding great bond ideas, as his track record proves.

But our strategies are different in some important ways…

Mike DiBiase’s approach involves bonds a lot closer to the “razor’s edge.” The payoffs can be big, but the risks are higher.

And they’re much harder to find.

Our strategy is high-yield but not “distressed.”

Meaning, we are fishing in a very different pond than Mike’s.

In our space, we have far less worry about legal issues or bankruptcy. Where we know the company can easily cover the debt, based on Uniform Accounting, forensic analysis, and our other proprietary methods.

And the volume of opportunities in this space is much, much higher.

So, if you’re a Credit Opportunities reader and you like what Mike DiBiase has done, and you’d like even more opportunities that are a little bit less distressed… and lower risk… with an extra edge from our Uniform Accounting analysis…and a bigger focus on building layers of consistent, high-yield income right through this crisis….

Then Credit Cashflow Investor is perfect for you.

And when you join today, one of your FREE bonuses includes a bond idea Mike has very generously agreed to share with Charter Members this week.

Click here to review the full Charter offer, before it expires.

Question #8: What are these Credit Cashflow Investor seven special bonuses I keep hearing about?

I want to give you everything you need to protect and potentially grow your wealth during the coming crisis.

Here’s everything you’ll get when claim Charter access today:

- 50% OFF One full year of Credit Cashflow Investor

- Instant access to Cashflow Now: 10%-Plus Bonds to Start Your Credit Cashflow Investor Portfolio

- Instant access to The Secrets of Credit & Our Credit Cashflow Investor Strategy

- Instant access to Avoid the Carnage: 10 Stocks to Make Sure You Don’t Own

- FREE BONUS #1: One FREE year of the brand-new Credit Analyzer

- FREE BONUS #2: One FREE year of the Altimeter Pro

- FREE BONUS #3: One FREE year of Timetable Investor

- FREE BONUS #5: A Safe Stansberry Bond Trade Yielding 7%

- FREE BONUS #6: My Never-Before-Seen Private Credit Talk to $1 Million+ Net-Worth Investors

- FREE BONUS #7: Investing Outside the Stock Market

And it’s all backed by our 30-day, 100% Satisfaction Guarantee so you can get a full credit refund anytime in the next 30 days.

Click here to review the full Charter offer, before it expires.

Question #9: What exactly are you looking at when you’re analyzing these bond opportunities?

When it comes to analyzing bonds, there are two big areas we look at…

One is cashflow analysis.

This is how we see all the company’s real obligations – whether it’s interest, debt maturities, R&D, capex, rent – and exactly when they come due.

This is the truest picture of the cash flow sources and uses of a firm over the next several years.

We clean up all the bogus accounting tricks that cover up the truth in earnings and balance sheets… and see how much cash is really coming in and going out.

We want to know: If a company has more coming in than it needs to spend on its bond payments, for years to come… will the company be able to pay you?

Another big credit metric we look at is the firm’s recovery rate.

Quite simply, we look at everything they own. The value of their working capital, their intellectual property, their real estate. And then we stress it. We pretend everything gets worse.

Because we want to know, will they be in a great position to cover their debts even in the worst-case scenario?

Here’s an example…

We did this analysis recently on a bond from Victoria’s Secret, where the bond was offering a double-digit yield, far higher than other similar bonds were offering of about 4%.

(That already is a huge green light for diving into an opportunity.)

Looking at the yield is just another way of evaluating a bond, same as looking at the price.

In other words, the market was judging this bond as risky and giving it a high yield as a result. But we didn’t think it was very risky at all.

The market saw declining revenue… and a lot of trouble for brick-and-mortar retail in general.

However, WE saw a company whose cash flows exceeded all obligations by $300 million a year. That’s a nice solid buffer of around 25% to 30%, which we love to find.

They also don’t have any debt coming due until 2027. That’s four years before they even have to worry about it, with cash piling up.

Which tells us they’re going to have NO problem covering the debt.

Even better: Victoria’s Secret has outstanding debt of just $1.3 billion. That’s not just this bond but everything they owe.

Now what goes through your mind when you see that the company is ALREADY sitting on more than $2 billion of assets, far beyond their total debt?

Their real estate… merchandise… cash and liquid assets…

We add them up to get a conservative number, meaning we got to it by distressing the assets – assuming real estate prices actually fall, that inventory could be valued at far less than reported on the books, that kind of thing.

And they still have far more than their total debts. That means they’re in a strong position to refinance if they need to. You have a lot of added safety in terms of recovering your debt even in a bankruptcy.

But from what we see, there’s almost zero chance of that happening.

So, this is an example of a bond that could give you a 30% capital gain PLUS a double-digit yield.

And we spotted this back in July for our institutional research clients.

Meaning, the yield and potential return are at the lower end of the performance we expect to see going forward as the market gets crazy.

And we have more where that came from, waiting for you inside Credit Cashflow Investor.

Click here to review the full Charter offer, before it expires.

Question #10: Is there a replay of the Joel Litman’s Big Warning presentation available anywhere?

Yes, at least today, you can access a full replay right here.

We’ve been focused on stock research because stocks have been the unquestionable place to be since we launched Altimetry.

The last 13 years were the greatest stock bull market in history.

It was a time to be in stocks in general, across the board.

This time – today – is NOT.

This is the beginning of a very different period – one where bonds will be king.

You want to be heavily in bonds today, much more than any other time.

I’m blessed to be leading this firm with Rob, and everything we’ve done – stock research was the right way to launch our business.

We are also very, very judicious about launching new research.

We want to be providing the right research and the right recommendations at the right times.

I’d rather be focused and have our clients focused than be pushing a mess of 15 different confusing things that try to be everything to everybody.

For example, you didn’t see us rushing out an AI-related service during the recent mania. Nor cryptos… or SPACs… or any other similar trend.

We only launch a new service when we’re sure it’s the best and most important thing we could possibly bring to you as a reader… and we’re sure we have the right team, led by Rob, for our brand-new Credit Cashflow Investor.

Again, we just published your first five bond opportunities. You’ll receive all of them as soon as you sign up today.

I believe each of these opportunities will give you the chance to double or even triple your money in the months and years ahead, even if the stock market goes over a cliff (and it will).

But just to make sure you have the highest possible chance of seeing those gains…

I’m still including $13,400 worth of free bonuses DESIGNED to show you the greatest potential profits… with the least amount of risk (and worry).

And if you act now, you can lock it in for just HALF of the normal price.

We haven’t raised the price or removed any of your free bonuses yet.

Click here to review the full Charter offer, before it expires.