Luke Lango’s 1000% Divergence Window is a rare stock market phenomenon. This market phenomenon is emerging right now. And the window of opportunity to capitalize on it is rapidly approaching…

Here Luke Lango shares details about this once-in-a-decade stock market phenomenon and how to profit from it.

Table of Contents

- 1 Watch Luke Lango’s 1,000% Divergence Window broadcast ASAP

- 2 Luke Lango’s 1000% Divergence Window – The Money-Making Opportunity of the Century

- 3 Luke Lango’s 1000% Divergence Window – This Is Your Shot at Turning Today’s Market Volatility Into Your Personal Fortune

- 4 Some HUGE 2022 Divergence Examples

- 5 The Bigger the Divergence, the Bigger the Returns

- 6 Luke Lango’s 1000% Divergence Window: The Final Word

Watch Luke Lango’s 1,000% Divergence Window broadcast ASAP

Everyone is afraid that a recession may happen soon.

Here’s a news flash:

We may ALREADY be in a recession.

Think about it…

Home sales are slowing… consumer sentiment is at decade lows… consumer spending is at a crawl…

All we need is one more quarter of negative growth, and boom. We’d officially be in a recession.

A lot of signs point in that direction – and it could just get worse.

The question is, Are you ready for it? Or are you going to be blindsided like most folks were in 2008?

If you’re looking for a way to not only protect yourself but actually grow your wealth…

Take a look at this chart:

Those lines on the bottom represent the overall market in late 2008 and 2009…

And the lines on top are what Luke Lango calls “divergence” stocks.

As you can see, this group of stocks continued to soar, even as the overall market was falling.

After analyzing hundreds of back-tested charts, Luke believes this same phenomenon is happening right now – in 2022.

And that’s exactly why he has been pounding the table for everyone to watch his 1,000% Divergence Window broadcast ASAP.

I can’t stress enough how time-sensitive this is.

A lot of folks are going to be taken completely off guard as this market volatility continues.

But you could have the chance to make massive gains – no matter what happens in the overall market – simply by investing in these divergence stocks right now.

If you haven’t had a chance to check out Luke Lango’s 1,000% Divergence Window broadcast yet, click here to watch it now.

Luke Lango’s 1000% Divergence Window – The Money-Making Opportunity of the Century

What a wild year in the markets, huh?

Aside from being one of the more volatile markets we’ve seen, it’s downright scary.

Against that backdrop, I wouldn’t blame you for wanting to take cover from the storm. But the great Warren Buffett once said that it’s best to be greedy when others are fearful.

And right now, everyone’s fearful.

Over the past several months, however, my team of elite research analysts and I have embarked on an ambitious project: studying the intricacies of stock market crashes throughout modern history.

And we discovered a rare stock market phenomenon that occurs about once every 10 years. Through backtesting, we’ve found that this anomaly consistently provides the best buying opportunities in the history of the U.S. stock market. Moreover, we’ve figured out how to quantitatively identify when this phenomenon will happen next.

As such, we have engineered a way to best take advantage of the coming divergence to rake in massive profits.

Well, folks, guess what? This ultra-rare stock market phenomenon is emerging right now. And, as the window of opportunity to capitalize on it is rapidly approaching., our models are flashing bright “buy” signals.

To prepare you, I wrote a deep-dive essay on the first divergence, which you can read here. It also features a video appearance by Louis Navellier, which you do not want to miss!

Sign up here as we track this rare market event. This is truly an opportunity that’s too good to pass up!

The 1,000% Divergence Window is knocking on our doors, and it could hit at any time! It could even be as soon as tomorrow. But whenever it happens, make sure you’re ready.

Luke Lango’s 1000% Divergence Window – This Is Your Shot at Turning Today’s Market Volatility Into Your Personal Fortune

You should, by now, know all about the ultra-rare divergence phenomenon emerging in the stock market for the first time in 14 years.

You know that it’s all about stock prices diverging from their core fundamentals. You know that it only emerges during periods of peak market volatility. You know that it has consistently delivered investors the chance to double or triple their money in 12 months and score 10X returns in five years. You know it’s so powerful that it sends divergence stocks higher even if the market crashes.

You know that it’s the financial opportunity of a lifetime.

But did you know that the divergence we’re seeing emerge right now is the biggest one yet?

That’s right. We saw huge divergences in 1988, 2001, and 2008. But what we’re seeing in 2022 is a bigger divergence than any of those by a wide margin.

Our analysis suggests that the bigger the divergence, the bigger the potential returns.

You can forget doubling or tripling your money in 12 months…

The opportunity in the 2022 Divergence could be much, much bigger.

Some HUGE 2022 Divergence Examples

To recap, divergences happen when stock prices diverge from their fundamentals. The best way to illustrate this is by comparing a company’s stock price with its revenues.

The two should always trend in the same direction. If revenues are moving higher, the stock should be moving higher, too. If revenues are dropping, the stock should be dropping, too.

Divergences occur when this immensely powerful relationship breaks. That is, a divergence happens when revenues and earnings keep moving higher, but the stock price drops, creating a generational buying opportunity in the divergent stock.

Right now, we are seeing some huge divergences emerge in certain stocks across the market. Indeed, these are some of the biggest divergences we’ve seen in the history of the stock market.

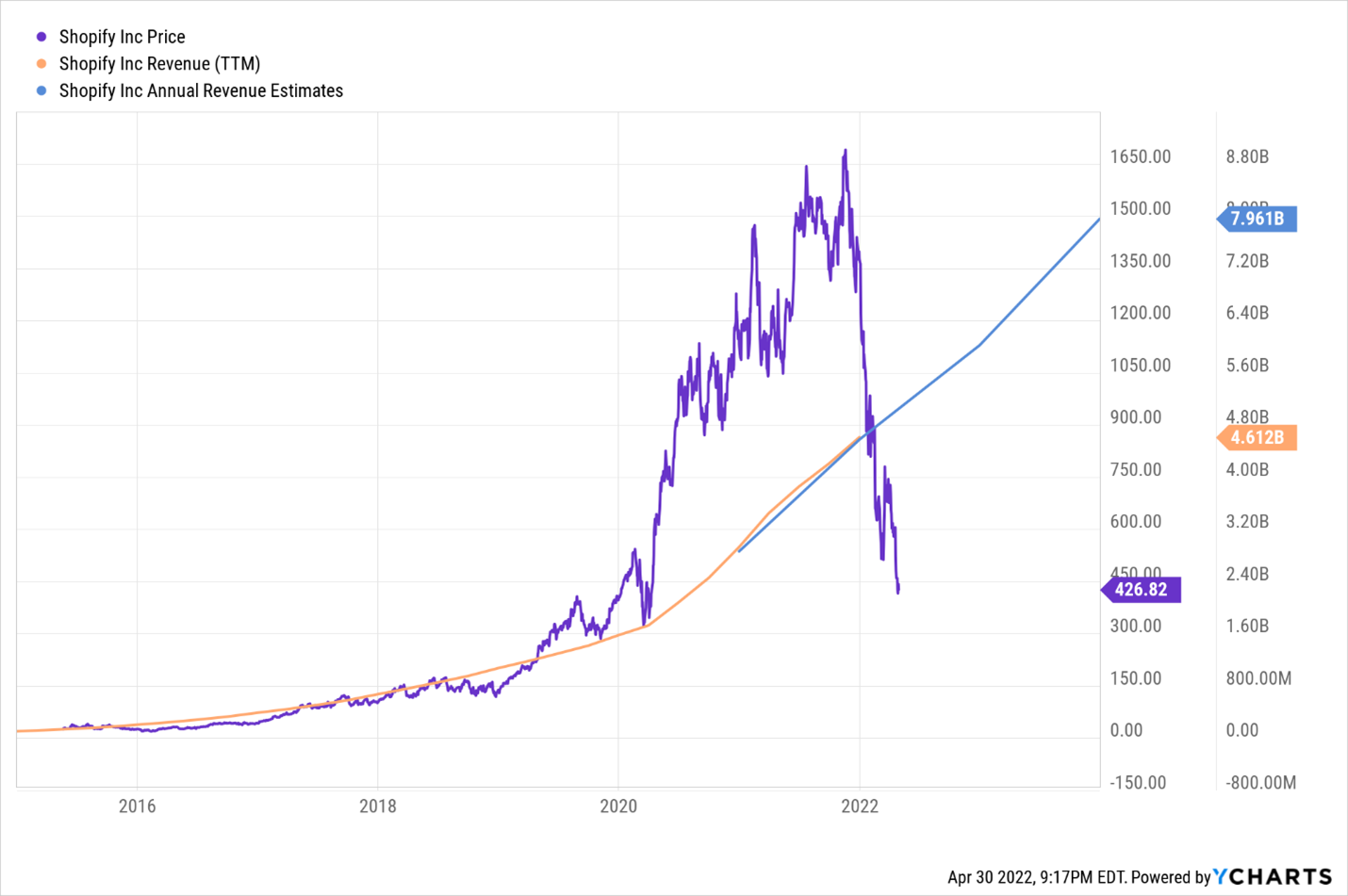

Take Shopify (SHOP), for example.

Shopify is a provider of e-commerce solutions to small- and medium-sized retailers. The company is riding the wave of online selling trends and the democratization of retail. Their revenues have been, still are, and projected to keep growing very quickly. Yet, the stock price has collapsed recently, creating what is an enormous divergence between fundamentals and the stock price. By the numbers, this is one of the largest divergences we’ve ever seen.

See the chart below. Historically speaking, what normally happens next is the purple line snaps back very rapidly to the blue line, setting the stage for quick triple-digit gains in the stock. Our numbers indicate that, due to this divergence, Shopify stock could double in a hurry.

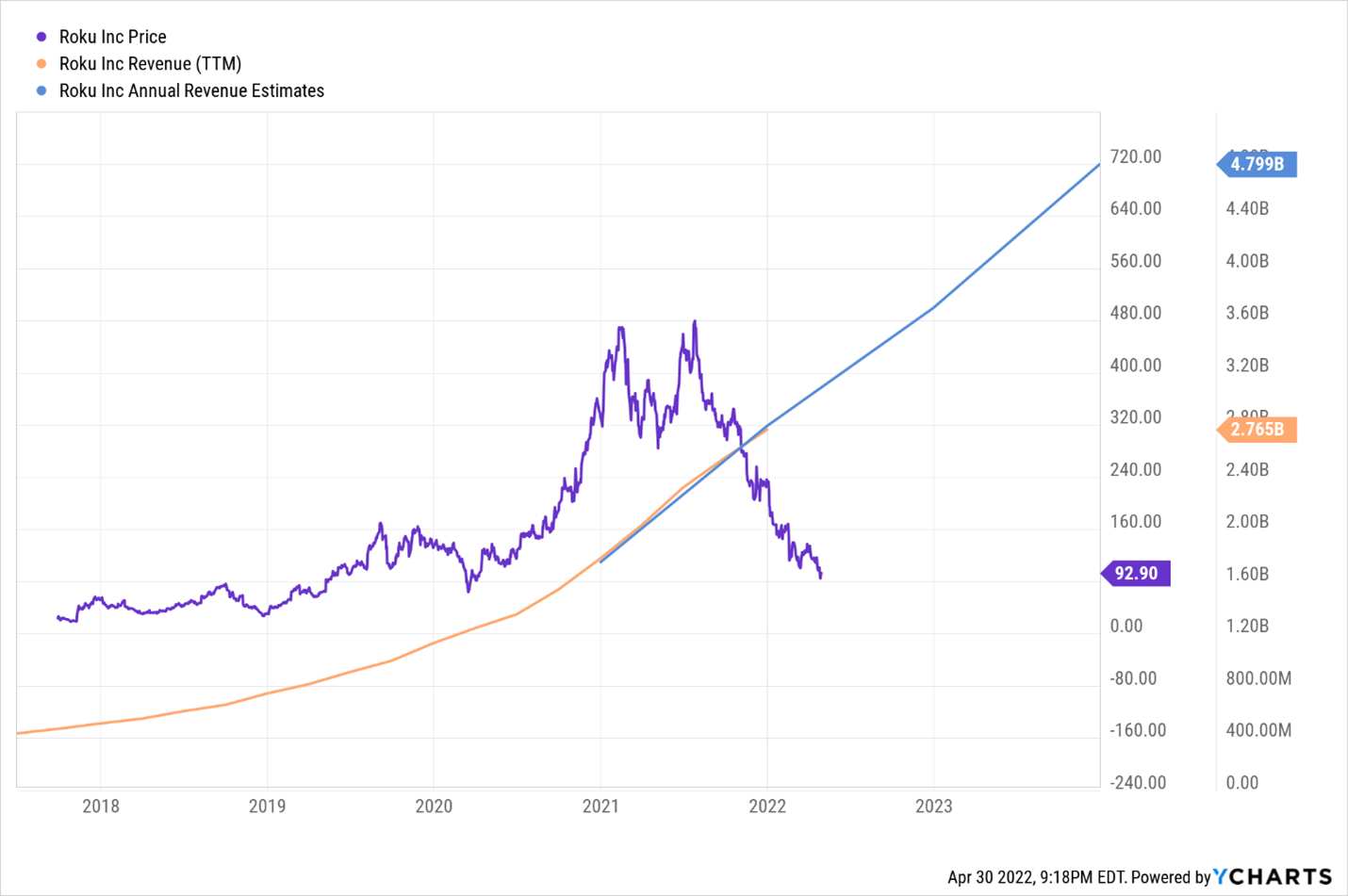

Or consider Roku (ROKU).

Roku is a streaming device maker that operates a connected TV software ecosystem that connects consumers to their favorite streaming services. It is the “cable box of streaming TV.” The company has always, still is, and will continue to grow like wildfire as more and more users, content, and ad dollars shift into the streaming TV space.

Yet, the stock price has collapsed recently — without a drop in revenues — creating an enormous divergence. Our numbers indicate that this is one of the largest divergences in history and will result in a fast, 200%-plus rally in Roku stock.

The list goes on and on. Across the stock market today, we are seeing some huge divergences emerge in individual stocks with great growth potential. This is creating an ultra-compelling investment opportunity, the likes of which we haven’t seen since 2008.

That’s the good news.

The better news? Divergence 2022 is bigger than anything we’ve seen yet — meaning the returns going forward could be bigger than anything we’ve seen yet, too.

The Bigger the Divergence, the Bigger the Returns

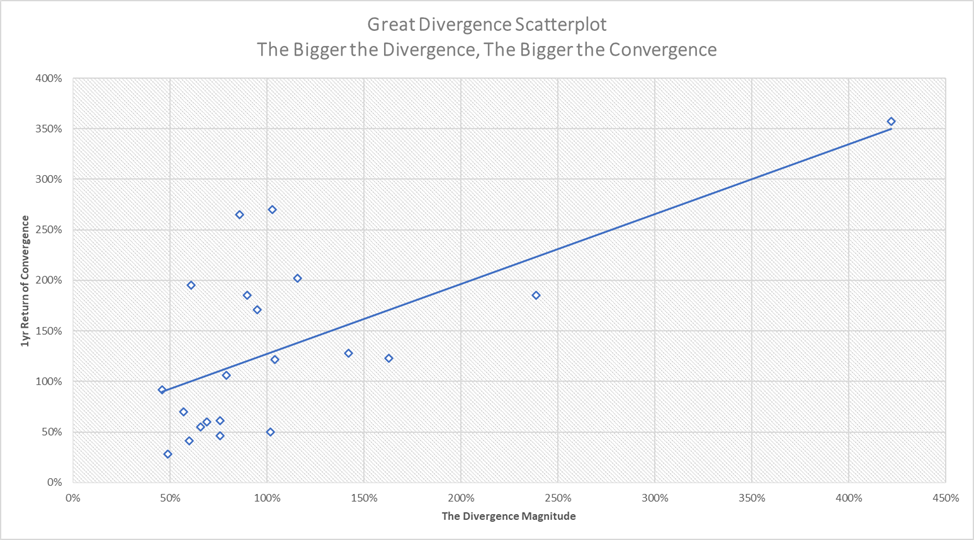

One of the more interesting discoveries we made about these divergence phenomena is that, in short, size matters.

That is, we’ve found that the bigger the divergence, the bigger the convergence.

Take a look at the following scatter plot. It graphs the size of various divergences (the x-axis) alongside the size of the 12-month forward returns in those divergences (the y-axis) across multiple historical examples from 1988, 2001, and 2008.

Clearly, there is a positive relationship between divergence and returns. The bigger the divergence, the bigger the forward returns.

That’s important, because as noted earlier, what we’re observing today across the market are some of the biggest divergence examples we’ve ever seen.

Of course, there’s Shopify and Roku. But, relative to some of the other divergences out there, those are small.

Right now, we’re seeing some stocks reporting divergence magnitudes of 500 percentage points or more.

Those are the stocks that stand to win the most in Divergence 2022 — and they are the stocks I’m researching intimately right now.

Luke Lango’s 1000% Divergence Window: The Final Word

The greatest stock market phenomenon in the history of capitalism has arrived on Wall Street for the first time in 14 years.

Investors plugged into this phenomenon could make a lot of money over the next 12 months. Those unaware of it — and those who ignore it — could lose a lot of money over the next 12 months.

That’s why I highly urge you to sign up for our Divergence 2022 Watch.

We’ve basically created a watchlist to keep investors up to date on the latest divergence developments. Most importantly, we plan to broadcast an emergency briefing to that watchlist as soon our models flash the “all-in” buy signal on the divergence phenomenon — and that could happen any day now.

In that briefing, we will unveil our top stocks to buy to capitalize on this rare market phenomenon — the stocks which, based on our models, are the most divergent in the market today, and therefore, have the most upside potential as this market anomaly resolves itself.

Trust me. This is a phenomenon you don’t want to — and, quite frankly, can’t afford to — miss.

So, sign up to the Divergence 2022 Watch and I’ll personally make sure you don’t miss it.

Instead, you’ll be among the first to hear my team’s groundbreaking strategy to capitalize on this rare market phenomenon and turn today’s market volatility into triple-digit gains.

1 thought on “Luke Lango’s 1000% Divergence Window – Legit Money Making Opportunity?”