Register for Louis Navellier’s and Matt McCall’s Road Map to Recovery event during which they’ll walk you through their investing Power Portfolio Reloaded plan…

Table of Contents

Road Map to Recovery Event – Watch The Replay Here

The response to Matt McCall’s and Louis Navellier’s Road Map to Recovery event has been overwhelming.

You can watch a replay here.

Many investors now have the exact road map they need to follow for the chance to drastically outperform the markets in 2021.

More specifically…

They now have access to a small group of stock recommendations that could help them beat the markets by nearly 11X or more over the next year.

Matt McCall and Louis Navellier also extended one of the most generous offers in InvestorPlace history.

Normally, you’d have to fork over $12,995 dollars for InvestorPlace’s Omnia membership, which includes Matt McCall’s and Louis Navellier’s best stock recommendations, along with other editors’.

But Matt and Louis both went to bat for you and convinced their CEO to give you the best possible offer.

So, you won’t pay $13,000… or even $2,000…

Click here to watch the replay of the event and learn more about this incredible offer.

RoadMap to Recovery Portfolio: Unleashing Pent-Up Demand Creates a Massive Opportunity

Let’s take a little trip down memory lane…

Close your eyes and take yourself back in time. Imagine walking into your favorite restaurant… and sitting down at any table you choose.

Imagine not wearing a mask or getting your temperature taken before entering the restaurant.

Imagine walking over and saying hello to a neighbor… and even shaking his hand.

Imagine having a nice dinner with no fear of getting yourself or someone else sick.

Then… imagine everything else we used to do before COVID-19 hit.

Just 13 months ago, shutdowns changed our daily lives. So many things we did without a second thought were taken right out from under us in one pull of the rug.

I believe many of us miss the simple things in life the most – at least, I do. And as simple and even inconsequential as returning to your favorite restaurant might sound, don’t underestimate its significance.

Your meal out is but one drop in an ocean that will flood our economy as things get back to “normal.”

This pent-up energy to see family, travel, go to your favorite restaurant, attend a concert or movie or show, shop for new clothes… or whatever it is you like to do… is going to lead to one of the biggest booms in the history of the U.S. economy.

I’m calling this the “Great Grand Reopening.”

This Great Grand Reopening (or “GGR” for short) will produce one of the most lucrative investment opportunities you can find for the next one to two years. As people around the world begin to return to normal life, it will unleash demand for goods and services, and it will unleash spending that will lead to a boom for the economy and huge profits for stocks – especially those best positioned to capture that pent-up demand.

The potential profits in this Great Grand Reopening are too juicy to ignore, and now is the time to get in position.

— RECOMMENDED —

Louis Navellier and Matt McCall are widely recognized as two of the world’s most accomplished investors. For years they’ve worked by themselves and helped thousands of people learn how to see incredible gains. Now they’re teaming up to deliver a shocking warning about 2021.

Sign up for FREE by clicking here.

Here Comes the Economic Snowball

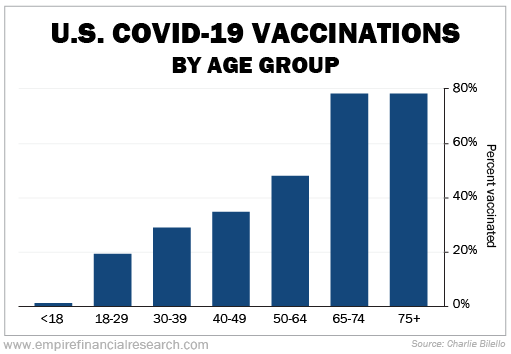

You don’t need an advanced degree to understand the reasoning behind the GGR. Multiple vaccines have been developed in record time and are proving remarkably effective. More than 35% of the U.S. population has received at least one dose of a vaccine, and in the highest-risk age group of 65 and older, nearly 80% have received at least one dose.

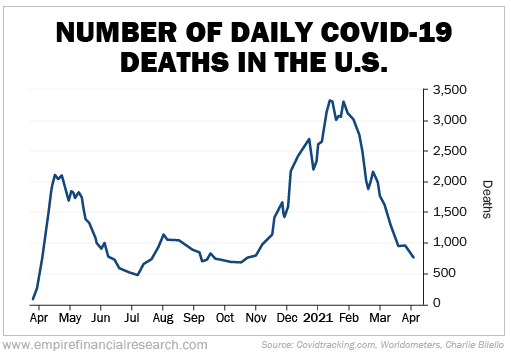

The biggest concern during the pandemic was not so much the number of people contracting the virus, though that was obviously critical. The primary concern was how many people were affected severely, which would raise the number of deaths and could overload the health care system.

The situation has improved dramatically. As vaccinations have increased, deaths have decreased…

This means that at some point soon, I should be able to see my parents, siblings, nieces, nephews, and other loved ones that I haven’t seen since the end of 2019. From a human standpoint, that is more important than money will ever be. But… let’s think this through from an investing perspective, too.

When my family is finally able to get together in the near future, several of us – myself included – will have to drive several hours to the designated location. That will require much more gasoline than I have used in months.

I’ll probably go on a bit of a shopping spree ahead of time. I could use a new pair of shoes and a shirt. I will also pick up gifts for my nieces and nephews because of the holidays and birthdays we’ve missed. The food will be plentiful, and the drinks will be flowing.

In normal times, the amount of money we’d pump into the economy for a family reunion of sorts would hardly be noteworthy. But these past 14 months have been anything but normal, so take my scenario and multiply it by tens of thousands of families, if not more. That’s a huge amount of money flowing into the economy.

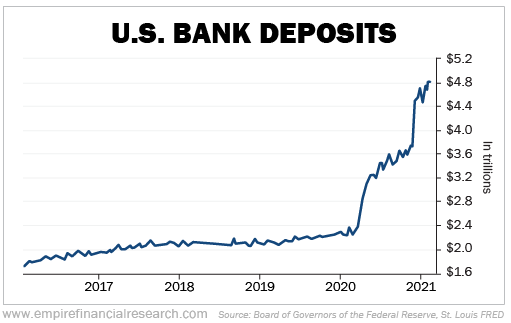

You might think there is not enough money to support such spending with businesses closing and jobs lost. But here’s the good news: The money is there for a lot of people.

Look at the amount of money in checking accounts around the country. It just hit an all-time high of $4.8 trillion, which is way above the $2.3 trillion at the end of 2019. In 15 months, the amount of money in checking accounts has more than doubled…

The same is true for both savings accounts and household net worth, recently spiking to all-time highs.

When the amount of money in savings and checking accounts, now combined with new stimulus checks, starts to hit the economy by way of travel, food, clothes, entertainment, etc., it will have a massive trickle-down effect. That trickle-down effect will fuel the Great Grand Reopening.

So, here’s the road map: Money on the sidelines moves back into the economy, providing a boost and more jobs. This in turn will be good for corporate profits. And at the end of the day, we know that higher corporate profits drive stock prices higher.

Still, we can’t forget that parts of the stock market and the economy will never be the same moving forward. That’s why as things begin to get back to normal, you want a proven road map to help you beat the market no matter what happens next.

My colleague Louis Navellier and I will explain the opportunity ahead of us and reveal our brand-new investing road map during our “Road Map to Recovery” event on Tuesday, April 20, at 7 p.m. Eastern time. The last investing road map we created gave our readers the chance to beat the markets by nearly 11 times, and we’re fired up about what’s to come.

The grand reopening is a rare opportunity over the coming 12 to 24 months. It’s already starting, so now is the time for investors to make their move.

You don’t want to miss this free event… You can register to attend right here.