Is Whitney Tilson Quant Portfolio worth your time and money? Find out in this detailed Quant Portfolio review that covers everything you need to know about this research.

On their 25-year anniversary, Stansberry Research unveiled the biggest investment breakthrough. This is a completely new way to see which stocks could double your money. Their back tests show this strategy has 91% accuracy. You would normally need $2 million to access it so read further for all exciting details.

Whitney Tilson Quant Portfolio Key Takeaways

- Stansberry Research has developed a new systematic way to find out which of the 4,817 different stocks could double your money. It has 91% accuracy by measuring the likelihood of every potential outcome, BEFORE you get in, including the optimal time to buy.

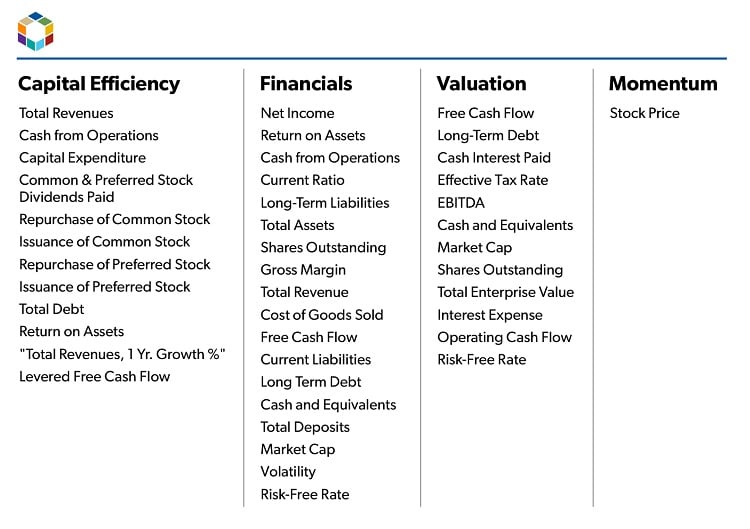

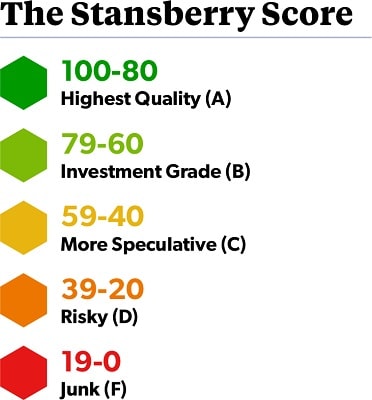

- The Stansberry Score is using capital efficiency, financials, valuation, and momentum to rank which stocks offered the greatest potential upside, and the least amount of risk. The scores ranged from 0 to 100, with anything over 80 being a great opportunity.

- The system takes all stocks with the greatest score. Then, by using the Monte Carlo Method, explores every possible combination of those stocks to generate precisely a thousand different portfolios. Finally, it calculates which portfolio can yield the maximum, consistent return for you.

- Stansberry’s system shows you, based on the size of your portfolio, EXACTLY how much money to invest in each stock. You can get access to this new technology as part of the new subscription called The Quant Portfolio.

- Whitney Tilson’s reveals his prediction for 2024, along with his #1 favorite little stock to buy now, using the breakthrough and the #1 stock to avoid.

Table of Contents

- 1 What Is The Newest Breakthrough from Stansberry Research?

- 2 How Does The Stansberry Score Work?

- 3 How Can Whitney Tilson Quant Portfolio Point To So Many Winners?

- 4 Whitney Tilson Quant Portfolio: What Is The Monte Carlo Method?

- 5 Whitney Tilson Quant Portfolio: How to divide your cash?

- 6 Whitney Tilson’s Prediction for 2024

- 7 Whitney Tilson’s Free Recommendations

- 8 Is Whitney Tilson Quant Portfolio Legit?

- 9 What Is Whitney Tilson Quant Portfolio And How It Works?

- 10 Whitney Tilson Quant Portfolio – What’s Inside?

- 10.1 One full year of The Quant Portfolio

- 10.2 The Stansberry Score system

- 10.3 The Quant Master Class

- 10.4 Special Report: Top 3 Quant Stocks for 2024

- 10.5 Special Report: Top 5 Stocks to Avoid in 2024

- 10.6 Research Report: Quant Investing: How to Double Your Money By Seeing The Future Outcomes of 4,817 Stocks

- 10.7 Special Updates

- 10.8 Whitney Tilson’s warnings and predictions

- 10.9 Whitney Tilson’s Private Briefing

- 11 Whitney Tilson Quant Portfolio Subscription Fee

- 12 Whitney Tilson Quant Portfolio Refund Policy

- 13 Whitney Tilson Quant Portfolio Verdict

What Is The Newest Breakthrough from Stansberry Research?

Whitney Tilson as known as “the most connected man on Wall Street,” recently joined Stansberry Research to share a breakthrough that he considers a must-have for every investor.

Stansberry Research developed a system that allows you to type in tickers and scan 4,817 different stocks to see which are most likely to rise 100% or more with the least chance of risk. It measures every possible outcome of what could happen to the stock BEFORE you get in.

It uses a Nobel-Prize-winning formula to measure debt and calculate how likely a company will go bankrupt. The system also measures all 58 factors you see below to calculate how likely it is to go up or down.

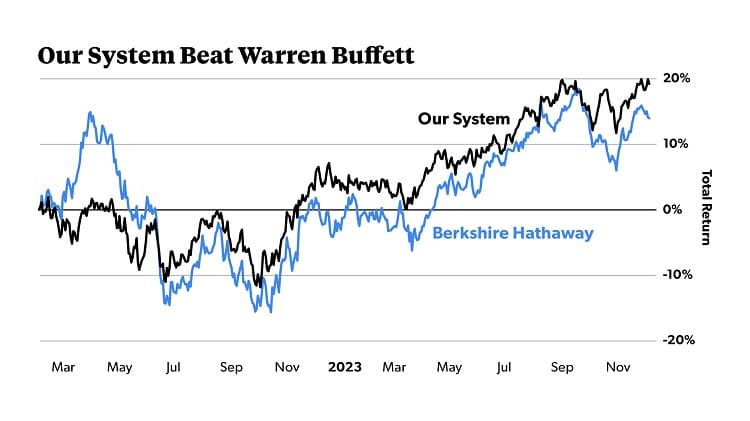

By using this system, you can now find low-risk, high-upside-potential investment opportunity EVERY MONTH, in every sector. The last two years it even outperformed Buffett.

How Does The Stansberry Score Work?

It all comes down to a breakthrough in using the Monte Carlo Method.

The system can create 1,000 different portfolios of all the best stocks… and simulate which could beat the market, with 91% accuracy.

Many years ago, Porter Stansberry noticed that the best recommendations have one thing in common: They are capital efficient and yet the broad market hadn’t picked up on that. This means the companies are very good at growing their profits. But the stocks are priced as if they weren’t going to grow.

Stansberry Research team realized that anytime you can find a situation like that, you give yourself a massive edge in the markets. A chance with extremely minimal risk and enormous upside.

Porter Stansberry’s quantitative method

As Porter Stansberry wrote in 2007: “I have come to believe evaluating capital efficiency gives us a permanent edge in the market, as almost everyone else ignores this crucial variable… Few people even understand the concept.”

Over the next eight years, he and his research team worked to develop a quantitative method for identifying these scenarios.

He had no idea that the system he would create would turn out to be their most profitable investment discovery in 25 years. Because the highest-scoring stocks have pointed to multiple triple-digit gainers.

After many years of hard work, the system now scores not just capital efficiency, but EVERYTHING that can affect the stock. This is a quant system you’d only ever find at some of the world’s top hedge funds. Here is a quick overview of the Stansberry Score.

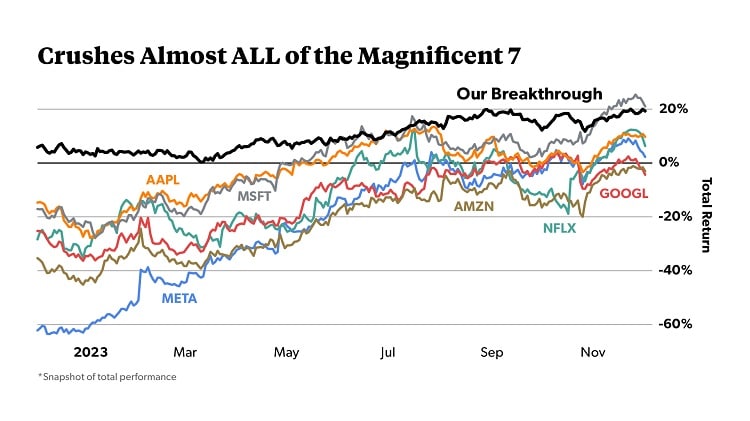

Stansberry quant system outperformed almost every popular asset for the majority of the past two years. Below is the graphic – it looks like it even beat Microsoft – during the height of all the ChatGPT mania.

And all you have to do is hold a small basket of stocks.

How Can Whitney Tilson Quant Portfolio Point To So Many Winners?

The Stansberry Score updates daily. And capital efficiency is only one of the factors it considers. The system also evaluates the financials, valuation, and momentum of each of 4,817 different stocks by measuring each of 58 different factors mentioned above.

The Score is able to assess breaking news in real time, such as a market fall, and the reactions of specialists and insiders to that information.

Whitney Tilson Quant Portfolio: What Is The Monte Carlo Method?

Simply said The Monte Carlo Method is an algorithm. It is the process of using a computer to “test” and simulate EVERY potential outcome of a given decision PRIOR to making it.

Stansberry’s system is built to model and generate 1,000 distinct portfolio future outcomes based on all the stocks with the greatest scores. To see the smoothest, biggest potential return.

It works out to 161 trillion combinations of stocks… ALL to boost your potential gain to 100% or more.

Here how it works:

First, Stansberry’s team allocate dozens of stocks with a Stansberry Score of 85 or higher.

Second, they upload the list to their computer to build a portfolio with high upside potential and incredibly low risk.

Third, the computer then runs the Monte Carlo Method assembling all those stock combinations into a single portfolio. It is following Stansberry’s algorithm by performing millions of computations to determine which combination will have the lowest risk and the biggest possible return.

It took Stansberry Research 10 years to develop this secret algorithm. More than $10 million was invested and a fixed data cost of $400,000 a year to pull this off.

Whitney Tilson Quant Portfolio: How to divide your cash?

Another incredible secret uncovered by Stansberry Research is that their system shows you EXACTLY how much money to put into each stock, based on your portfolio size.

You simply enter the amount into the calculator. And it breaks down exactly how much cash to put into each stock.

The portfolio changes about once a month. The reason is their quant system is constantly scoring 4,817 stocks, every day the markets are open. So read further for information on how this quant system reflects on the Tilson’s prediction for 2024.

Whitney Tilson’s Prediction for 2024

Tilson believes that stocks will rise more from now on. A continuation of the bull market from the prior year.

He believes the Magnificent 7 will no longer be the leaders on the market. Some of them are about to see a sharp collapse. Tilson’s recommendation is to get out now if you own popular stocks and especially popular tech stocks, like the Magnificent 7. Just a reminder that the Magnificent 7 consists of Apple, Amazon, Tesla, Nvidia, Microsoft, Meta, and Google.

Furthermore, old-fashioned buy-and-hold won’t work anymore. That’s why Tilson is recommending everyone to use the quant system that frequently evaluates the 4,817 different stocks.

Small caps are historically cheap right now compared to the S&P 500 and the Nasdaq.

Tilson thinks we can expect smaller companies to outperform this year. Compared to the bigger companies that have already come too far, too fast.

Whitney Tilson’s Free Recommendations

Whitney’s #1 stock to buy right now is Grupo Aeroportuario del Sureste. Ticker ASR.

Currently it scores 93, the highest-ranking stock in the Stansberry Score system.

The company is based in Mexico. It operates, maintains, and develops airports. It trades on the ordinary U.S. stock exchange.

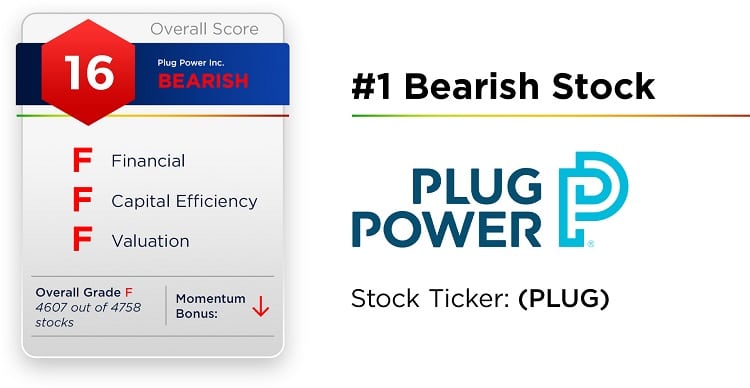

Whitney’s #1 stock to avoid is Plug Power, ticker PLUG. It receives a score of 16 in the Stansberry Score system.

Is Whitney Tilson Quant Portfolio Legit?

Many people are probably wondering now what is the point to invest in the market while we can see a solid 5% annual return in no-risk Treasury bills?

Stansberry Research is using a tested algorithm to show the highest potential returns with the least amount of risk. And their system is able to point to the best opportunities BEFORE you invest a penny.

The fact is, over the long run, you always want to be in the market. You don’t want to be left behind as new technologies lead to greater efficiencies and the economy expands.

The truth is that the days of consistently making money on the market are over. At least for now. This is a stock picker’s market – and the best stock pickers right now have a system.

Access to Stansberry’s quant system is possible as part of The Quant Portfolio. Stansberry Research has recently opened the doors for new members. Here is more about this first-of-its-kind research service.

What Is Whitney Tilson Quant Portfolio And How It Works?

Each month, the system finds a basket of stocks with astronomically high potential and incredibly low risk. This is possible by running the Monte Carlo Method on 1,000 possible portfolios. Each recommendation is vetted by a special committee, which includes Tilson and a team of Stansberry’s most experienced analysts.

After carefully consideration, members receive the names and details on how much cash to put into each in any type of market.

The portfolio will shuffle about once a month.

Members will receive an alert of exactly which stocks to sell… which to buy… and how to allocate their money.

For the first time, this system is now offered as a simple, all-in-one product designed for the general public. The retail price that Stansberry Research will charge going forward is $5,000 per year.

But because they are now opening, for first time ever, they knock 50% OFF the price for a limited time.

Thit means today, you can become a charter member of Stansberry’s new Quant Portfolio for just $2,500.

The offer includes a suite of bonuses and a 100% Satisfaction Guarantee.

Whitney Tilson Quant Portfolio – What’s Inside?

Here is a list of everything included:

One full year of The Quant Portfolio

You’ll see exactly which stocks to buy now, and exactly how much cash to allocate to each, depending on your portfolio size, for the chance to double your money with the least amount of risk. Chosen and vetted by Stansberry’s Investment Committee – which consists of Whitney Tilson and a handful of their best analysts – the model portfolio is designed to crush the S&P 500, gold, bitcoin, and popular stocks, as their live test has shown. It’s all driven by a system you’d normally need $2 million to access at a hedge fund.

The Stansberry Score system

Where you can type in any of 4,817 different stocks and run your own analysis. With one button, the system shows you which stocks have the highest chance of rising or falling, by posting an up-to-the-minute rating between 0 and 100, including a 4-factor breakdown of exactly how the system evaluates the stock.

The Quant Master Class

A step-by-step guide on how to use the Stansberry Score system to evaluate any of 4,817 different stocks. With one click, you can see the highest-scoring stocks… worst-scoring stocks… the best dividend payers… and more.

Special Report: Top 3 Quant Stocks for 2024

This new report names the top 3 companies going quant to boost their profits… like buying Netflix back in 2007 – when they first went digital – before the stock rose 12,000%.

Special Report: Top 5 Stocks to Avoid in 2024

The Quant Portfolio system warned about 12 stocks that fell over 80%, and two that went bankrupt. This new report names 5 companies that are huge traps right now.

Research Report: Quant Investing: How to Double Your Money By Seeing The Future Outcomes of 4,817 Stocks

Inside, you’ll learn:

- How to allocate your money into a portfolio of stocks chosen by the quant system…

- Why the portfolio updates every month or so to help you potentially double your money or better, with the least amount of risk…

- What goes into the quant system secret algorithm… and more.

Special Updates

Each month, you’ll receive a new briefing detailing the state of the market and the current positions. The portfolio will periodically shuffle. When it does, you’ll receive an alert on new stocks to buy, which stocks to sell, and when to change your position size.

Whitney Tilson’s warnings and predictions

He nailed the dot-com bottom, recommending Tractor Supply, before it rose 29,973%… AutoZone, before it rose 8,311%… Ross Stores, before it rose 7,968%… Predicted the 2008 housing crisis and the bottom of the market in 2009, both on 60 Minutes… The collapse of Bear Stearns and Lehman Brothers… Exposed a fraud at Lumber Liquidators… Called the bubbles in bitcoin (to the day), marijuana (to the hour), 3D printing stocks… the bottom of the Covid crash (to the day)… Warned about the 2022 sell-off… Warned about 12 stocks in 2022 that fell 60% on average… And has booked multiple gains of 100+% in his research, which five different billionaires have subscribed to.

Whitney Tilson’s Private Briefing

It cost $32,000 to attend an exclusive Las Vegas conference where previous guests include 12-term U.S. Congressman Ron Paul, NY Times bestselling author Michael Lewis, and 7-time Tour De France winner Lance Armstrong. Here’s what Whitney recently told this audience of high-net-worth investors about how to manage their money.

Whitney Tilson Quant Portfolio Subscription Fee

The Quant Portfolio normally costs $5,000 for one full year.

But If you get in today, you’ll receive 50% OFF, and a suite of bonuses.

That means you can receive one full year of The Quant Portfolio at the special price of $2,500.

Whitney Tilson Quant Portfolio Refund Policy

You’ll have the next 30 days to look over The Quant Portfolio. You’ll receive full access to The Quant Portfolio and Stansberry Score System for the next 30 days, along with everything else included with this offer.

Stansberry does not offer cash refunds. But if you’re not happy for any reason, you can contact their Member Services team within 30 days and receive a FULL credit refund for everything you paid, which you can apply to any other product from Stansberry Research.

Whitney Tilson Quant Portfolio Verdict

Porter Stansberry and Whitney Tilson made the dream of every investor come true. The Quant Portfolio, the most important new release in the 25-year history of Stansberry Research, can tell which stocks will be the winners.

This quant system will be a must-have in 2024 because it provides an improved method for evaluating different opportunities.

Knowing that you got a stock with a good Quant Score may give you the confidence it takes to hold on to that position long enough for it to work out for you.

Those of you that are already using another investment research system, can simply add The Stansberry Score to whatever you already using so you can double- or triple-check you’ve found the absolute best possible stock to buy. Remember, the world is going digital.

Whitney Tilson Quant Portfolio – See it today live in action!